• Buyer Closing Costs Explained •

If you’re planning to purchase a piece of San Diego real estate, there’s more to consider than just the big price tag on the property. One often overlooked aspect of buying a house in San Diego are the closing costs, which can sneak up on you if you’re not prepared. Before you get too caught up in the excitement of your new San Diego address, let’s break down what you need to know about these extra expenses.

What Are Closing Costs for Homebuyers

When you buy a house in San Diego, the mortgage and down payment aren’t the only expenses to consider. Closing costs are a collection of fees that are due when you finalize your home loan. These fees cover everything from escrow payment and broker compensation to deed recording costs and loan-related charges, all of which can vary depending on the specifics of your transaction.

Here’s a detailed breakdown all about paying closing costs on your San Diego mortgage.

Different Types of Closing Costs Explained

Every real estate transaction will differ on exact amounts, but in general, you can expect to encounter the following types of closing costs depending on the type of property you buy and which mortgage you use:

1. Upfront Costs

These overhead costs are paid upfront, out of pocket, to cover things like home inspections and appraisals that are key to buying any house in San Diego with a mortgage involved. Your home inspection checks out the property condition and flags any issues before you finalize the purchase, while an appraisal figures out the home’s market value and is required by lenders to make sure the loan amount is right. These costs are important for a smooth buying process, so be sure to include them in your budget.

2. Escrow Fees

These fees take care of the legal side of things like holding deposits, dispersing the funds, and making sure everyone sticks to the Agreement. Escrow fees make sure the transaction goes smoothly, so there are no surprises at closing. They also ensure that all the necessary forms and documents are properly filled out and compliant with the law. The Buyer and Seller may share these costs, depending on what’s been agreed to in the Offer. It’s a small price to pay for the peace of mind that everything is handled correctly.

3. Property Taxes & Homeowners Insurance

You’ll need to cover two months of property taxes at closing. Additionally, you’ll secure homeowners insurance to protect your new home. Both are essential to ensure everything is in order for your new property. These costs confirm your home is properly insured and that your tax obligations are up to date. Planning for these expenses ahead of time will help make the closing process go smoothly.

4. Mortgage Insurance

If your down payment is less than 20%, you may be required to pay Private Mortgage Insuarnce (PMI), which protects the Lender and increases your monthly mortgage payment. You’ll pay the first month’s PMI at closing. This insurance can either be included in your monthly mortgage payment or paid upfront as a one-time cost. PMI typically lasts until you’ve built up enough equity in your home, usually when your loan-to-value ratio drops below 80%, or until you refinance into a loan that no longer requires it.

5. Lender Fees

Lender fees include loan origination fees, application fees, and other charges related to processing your mortgage. They cover the costs of getting your loan approved and set up. While these fees can vary, they are an important part of the overall cost of borrowing. Ask your Lender for a breakdown of their fees for the mortgage you select. Make sure to review them carefully to understand what you’re paying for and to budget accordingly.

6. State & Local Fees

State and local fees in your closing costs include things like deed processing and recording fees, which are needed to officially record your property purchase. If your new home is in a Home Owner’s Association (HOA) community, you’ll also need to budget for prorated HOA fees. These costs can vary based on where you’re buying in San Diego County and the property itself, so it’s smart to check them out and factor them into your budget.

7. VA Funding Fee

The VA funding fee is a one-time payment made to the VA when you open a new VA loan. It can be paid upfront at closing or financed into your loan and ranges between 0.5% and 3.6% of the loan amount. Your individual cost may vary based on your down payment amount, loan type, and service status. Some types of VA loans have a higher funding fee if you’ve used your VA loan benefit before. On VA purchase and construction loans, making a larger down payment is the best way to lower your VA funding fee.

8. FHA Funding Fee

The Up-Front Mortgage Insurance Premium (UFMIP) is a one-time payment made at closing for FHA loans, designed to protect the Lender in case of default. This fee, usually 1.75% of the loan amount, is added to your mortgage balance and can often be rolled into the loan itself. It helps keep FHA loans accessible for buyers with lower down payments. Understanding UFMIP can help you budget more effectively for your new home purchase.

9. Flood Determination

Flood determination checks if your new home is in a flood zone. This usually costs a few hundred dollars and covers the review of flood maps and insurance needs. If your home is in a flood zone, you’ll need to get flood insurance for the life of the loan. Knowing about flood determination helps you spot potential risks and make smart decisions to protect your home.

10. Fire Determination

Fire risk determines whether your new home is at risk for fires. This fee, also a few hundred dollars, includes checking fire hazard maps and figuring out insurance requirements. If your home is in a high-risk area, you’ll need to get fire insurance to cover it. Understanding fire risk can help you avoid surprises and make better choices for protecting your property.

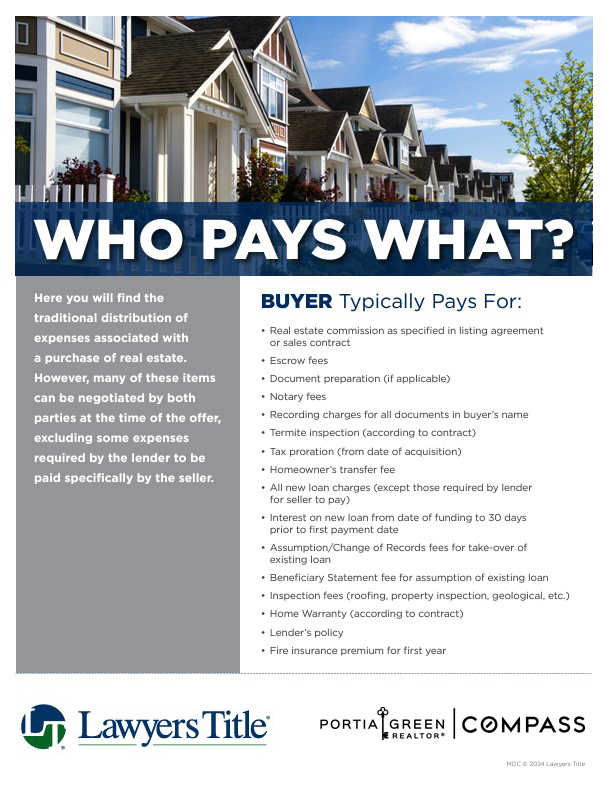

Who Pays the Closing Costs in San Diego?

Many people assume that the Buyer is solely responsible for closing costs, but that’s not always the case. Both the Buyer and the Seller often share these expenses. For instance, the Seller typically covers title insurance, county transfer tax, and can opt to cover real estate broker compensation while the Buyer handles mortgage-related fees, prorated property taxes, and home insurance. However, these costs are negotiable and can be factored into the Purchase Agreement.

How Much Are San Diego Closing Costs?

In San Diego, closing costs for Buyers generally range from 1% to 3% of the total purchase price. So, on a $1,000,000 home, you could be looking at anywhere from $10,000 to $30,000. It’s important to budget for these costs early on, so you’re not caught off guard at the last minute. Ask your Lender if you’ll need an additional mortgage reserve outside of the closing costs and down payments.

You have options for paying these costs: you can either pay them upfront as a one-time expense at closing, or you might be able to roll them into your mortgage. Just keep in mind that if you choose to finance your closing costs, you’ll be paying interest on them over the term of your loan.

The Bottom Line: Plan Ahead

Understanding closing costs is a big part of buying real estate in San Diego. While it’s easy to get excited about your new property, don’t let the closing costs sneak up on you. This breakdown of closing costs is thorough and covers the main charges that San Diego homebuyers should anticipate.

From escrow fees and prorated property taxes to loan origination fees and county surcharges, these expenses are an essential part of the San Diego homebuying process. Budget for them ahead of time and know what to expect, so you can ensure a smoother, stress-free closing.

Sources:

https://www.bankrate.com/real-estate/closing-costs-in-california/

https://www.rocketmortgage.com/learn/closing-costs

https://www.nerdwallet.com/article/mortgages/closing-costs-mortgage-fees-explained

https://www.investopedia.com/mortgage/mortgage-guide/closing-costs/

san diego home buyer closing costs, first time home buyer closing costs san diego, home buying closing cost assistance, what home buying closing costs are tax deductible, does a home buyer pay closing costs in san diego, what are closing costs on a house for a buyer, home buyer closing cost calculator, typical home buyer closing costs in san diego, cash home buyer closing costs, new construction home buyer closing costs, can a home buyer pay all closing costs, how much are closing costs for the buyer, does calhfa cover closing costs, redfin closing costs, redfin buyer closing cost calculator, zillow closing costs, zillow buyer closing cost calculator, opendoor closing costs, homes.com closing costs, bankrate closing costs, rocket mortgage closing costs, buyer closing cost breakdown, san diego home purchase closing costs, home buyer costs closing, first time home buyer grants closing costs, when purchasing a home who pays the closing costs, why do home buyers ask for closing costs, real estate buyer closing costs san diego, sd home closing costs, questions to ask before closing on a home, upfront home buying costs, va home loan closing costs, fha home loan closing costs, zero closing cost mortgage, san diego home buyer closing cost assistance

About The Author

Portia Green, REALTOR®

Portia’s clients all have a similar story. Most likely, you met her huddled around a tablet at the dinner table yet she feels like a friend. Her personable nature and easy going approach attract Sellers and Buyers alike, in what can be a stressful and emotionally charged event. A talented REALTOR® with 17 years experience, Portia is just as excited about real estate today as she was with her first transaction. She remains ever-committed to helping her clients find their place in the world and helping busy people navigate this crazy real estate market like a pro.

Related Posts

Bold Plays to Secure Home Insurance in San Diego

• Land the Best Coverage Options • Home insurance has become a…

Post-Holiday Budgeting to Keep Your Homebuying Goals on Track

• Pay Off Debt, Increase Savings • The holidays may be behind…

Thrive in 2025: Resolve to Conquer San Diego Real Estate

• New Year, New Market • As we ring in 2025, it’s…