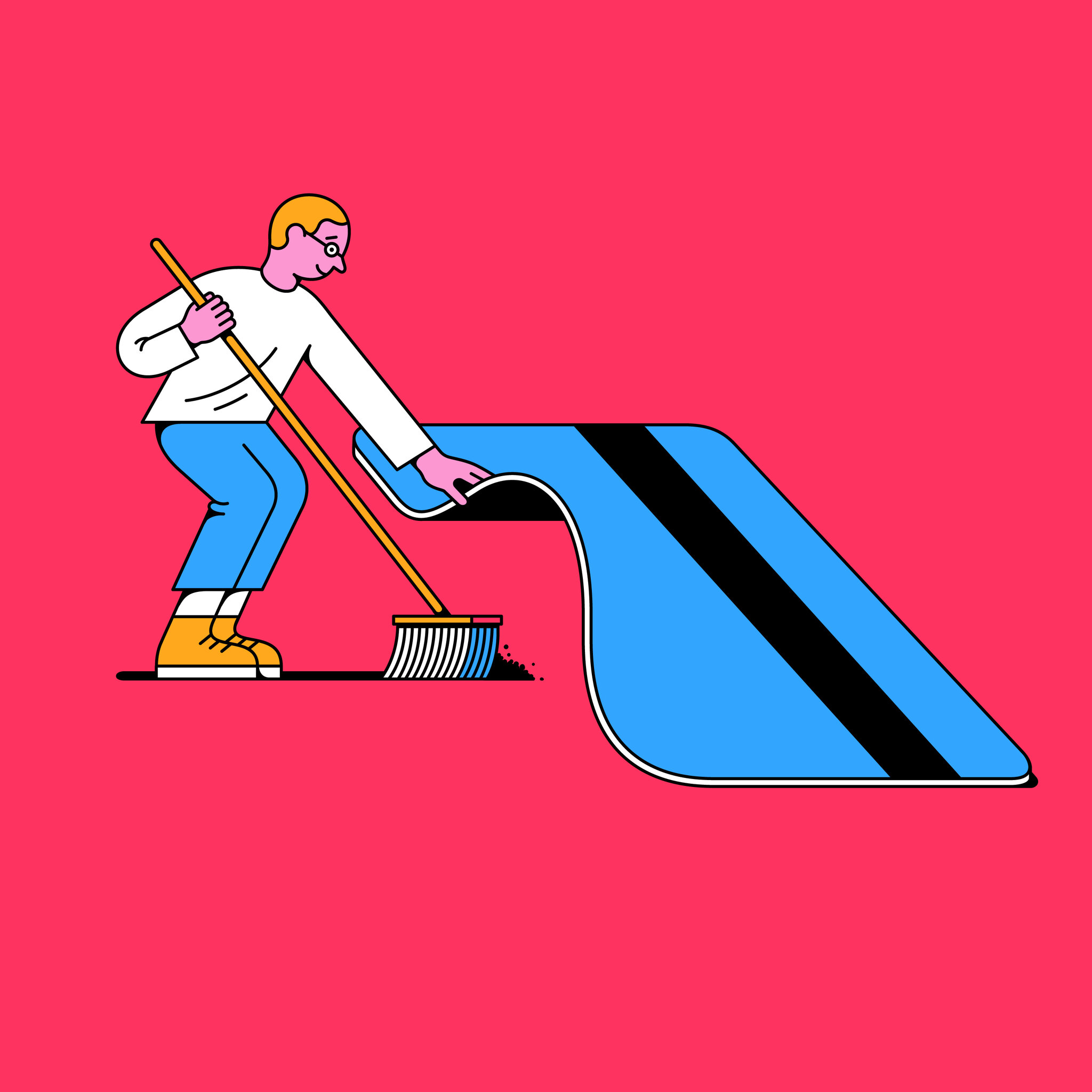

• How to Repair and Boost Your Credit Score Using Credit Cards •

Your credit score can have this sneaky way of making you feel either really amazing or really insufficient. Knowing it can impact everything from the deposit you give to the energy company to your ability to finance a car or a home…sitting on the sidelines while your credit score falls off into the abyss is just not an option. It’s time to step up your credit game!

So, what’s a consumer to do?

First things first, get your free annual credit report to check your credit and learn what you need to do to improve your credit score. You can do so without penalty, and for free through Annual Credit Report.com, which is a website jointly operated by the three major U.S. credit reporting agencies, Equifax, Experian, and TransUnion. This is vital for understanding your score and for making sure the information is accurate.

A study from Credit Sesame shows people with lower credit scores tend to avoid checking their scores to avoid bad news, and while this may be a temporary fix for avoiding having to deal with it, in the long run you are only hurting your credit score more.

“Don’t be 1 of the every 8 Americans who have never checked their credit scores!”

The next step to rebuilding your credit score is to determine what is negatively impacting it. Have you had credit lines open for a long period of time? Do you utilize less than 30% of your credit card limits? Are you making payments on time? Or, are you missing payments?

These are just a few of the important factors that impact how healthy your credit score is. Once you’ve determined what is affecting you the most, you can make a plan to improve those areas.

Make it a priority to improve your credit score

If you’re missing payments, perhaps you can set up auto payments to deduct from your bank account or calendar reminders of your bills. If you’re maxing your credit cards, maybe you find a side hustle that can bring in additional revenue to help lower balances and improve your credit score.

While it may sound counterintuitive, there are also some great strategies using credit cards to help improve your score and rebuild your credit. Let’s look at those:

1. Get a secured credit card for rebuilding credit

If you’ve had credit card accounts closed in the past, you could start rebuilding by getting a secured credit card. With these types of credit cards, you deposit money upfront as collateral and then it works just like a regular credit or debit card.

Shop around and ask for specific details, such as interest rates, before you choose a card. Also be sure that the issuer reports payments to all of the three major credit-reporting bureaus, as some cards only report to one or two of the credit bureaus.

And, don’t use over 30% of your credit limit, which is generally equal to the deposit you will need to place in order to open the secured credit card in the first place. For example, if you open a secured card with a $2,000 limit, the deposit will typically be $600.

2. Become an authorized user

You could ask a close friend or family member with good credit to add you as an authorized user on their credit card. Asking someone to add you as an authorized user shouldn’t be taken lightly, so be prepared with a plan that will reassure this person why he or she should add you. There are a few credit cards that allow the primary cardholder to set spending limits for authorized users, which can also aid in convincing someone to add you.

Becoming an authorized user won’t have a great impact on your credit score, because you won’t be legally responsible for the debt — but, it can boost your score because the longevity of the account will spruce up the overall age of your credit accounts.

Keep in mind you should become an authorized user for someone who has good credit, because if your account holder does not pay the credit card bill on time or missed payments, this can hurt both your score and their score.

3. Pay on time and in full

Your payment history makes up roughly 35% of your FICO score, so be sure you’re committed to making on-time payments. If you’re not currently using your credit cards, consider putting one or more of your typical monthly expenses (like your electricity bill) on the credit card and then pay it in full each month.

By doing so, the credit card issuer will report your on-time payments — thus helping you establish a good payment history. You also won’t pay any interest because you’re paying the full bill each month.

How Reali Can Help

Reali makes securing a home loan or refinance easy and simple. Get started by telling us about your unique situation and we’ll help you understand what kind of home loan is best for you and your family.

The Bottom Line

Call us at 858.880.0195 or email portia.green@compass.com to get started.