• Weighing the Benefits of Unlocking Your Equity •

Debt has become more expensive and, as a result, it is costing consumers more to make their minimum monthly debt payments. According to the Federal Reserve Bank of New York, Americans’ total credit card debt is currently $856 billion — with a stunning $52 billion increase between Q3 and Q4 2021.

Even with interest rates on the rise, they are still considered low — and equity levels rose nearly 30% between 2020 and 2021. In other words, the net savings of a cash-out refinance can still save consumers hundreds of dollars each month.

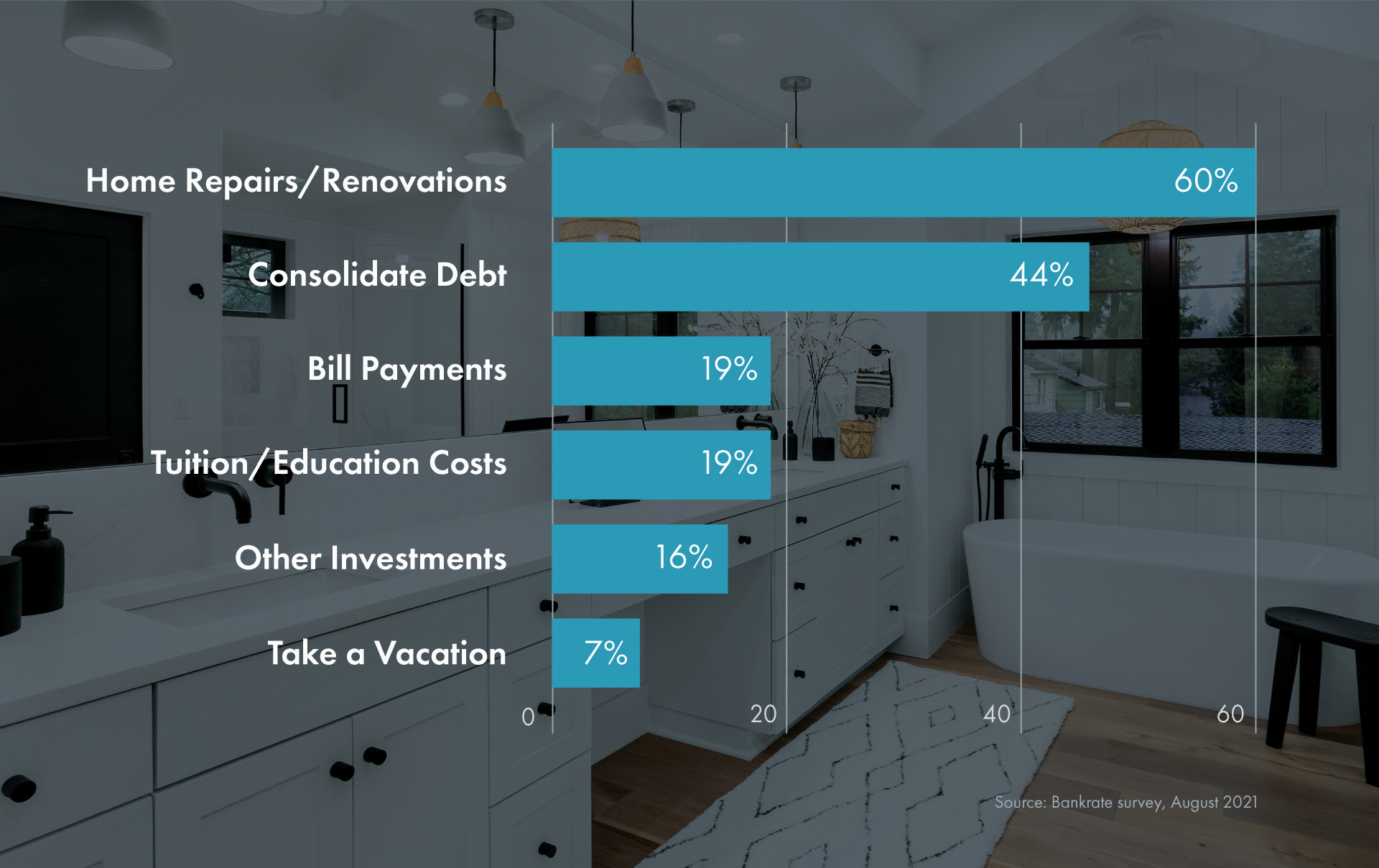

Reasons Why Homeowners Tap Equity

So, how do you know if it makes sense to tap into your home’s equity? To learn more about cash-out refinancing, including the benefits and how much you could save each month, check out our latest Refinance Guide.

The Bottom Line

Thinking about refinancing? We’re here to help. Call us at 858.880.0195 or email portia.green@compass.com to get started with Reali today.